How should you form your Motion Design business? From LLCs to S-Corps, lawyer Andy Contiguglia shares some important insights.

It’s pretty much common knowledge across the industry that if you want to save a ton of money and protect yourself legally and LLC is the way to go, but is that true? Business formation is one of the most important decisions you will ever make as a freelancer so it’s important to pick the right entity for you. If you choose unwisely you might end up paying double the taxes!

This week we sit down with lawyer Andy Contiguglia for the second time to finish our two part series on legal questions for Motion Designers. Andy’s insights are incredibly helpful. This podcast might save you thousands of dollars in the future.

If you haven’t heard part one check it out. It covers everything you could want to know about contracts.

Legal Stuff: Communication of information by, in, to or through this Web site and podcast and your receipt or use of it (1) is not provided in the course of and does not create or constitute an attorney-client relationship, (2) is not intended as a solicitation, (3) is not intended to convey or constitute legal advice, and (4) is not a substitute for obtaining legal advice from a qualified attorney. You should not act upon any such information without first seeking qualified professional counsel on your specific matter. The hiring of an attorney is an important decision that should not be based solely upon online communications or advertisements.

SHOW NOTES

RESOURCES

Business Formation Episode Transcript

Joey: Welcome to part two of the Andy Contiguglia episode. Who is Andy Contiguglia? Well, if you missed part one of this interview you may want to go back and start there in the previous episode. Andy is a small business lawyer based out of Denver Colorado. In the last episode we talked about dealing with clients, contracts and a bunch of other legal ideas and in this episode we're going to go deep into the topic of incorporating. If you're freelance, if you're thinking of starting a studio one day you're probably going to need to think about forming a corporate entity as they're called. I know it's confusing.

There's all these different kinds of corporations, S corp, C corp, LLC. There's different tax implications and we try to do our best to demystify all of that in this episode. First, I have to say of a whole lot of words so that we don't get sued.

The legal information contained in this podcast is intended for general informational and entertainment purposes only. It should be used only as a starting point for addressing your specific legal issues. The legal information I talk about does not create an attorney client relationship between you and me or you and Andy. This podcast is not a substitute for an in person or telephone consultation with a lawyer who is licensed to practice in your jurisdiction about your specific legal issue and you should not rely on this legal information for those purposes. You understand the questions and answers or other information contained in this podcast are not confidential and are not subject to attorney client privilege, neither I nor Andy are providing you a legal service. Every legal case is different and past performance is not indicative of future results. Bottom line, please consult your own paternity.

All right. Now, let's do this. Here comes part two.

Andy, now I want to talk about another enormous topic that we get questions about all the time and I know just enough to be dangerous but I imagine you're going to know a lot more about this is should I incorporate as a freelancer. So, why don't we just start with like the big question. Why would a solo freelance motion designer who sits in front of a computer and opens After Effects and makes animation, why would they want to think about incorporating?

Andy C.: That's a great question and again, the answer, it depends. It depends what your objectives are, it depends sort of what your big picture is going to be. There are tax benefits to it. There are employment benefits to it if you have employees. But I think the major reason that people tend to incorporate themselves, and when I say incorporate that's a real generalized term because there are corporations, there are LLC's, there are partnerships and there are sole proprietorship. Those are the four different types of business entities.

So when you're saying to incorporate those are your options. A solo practitioner is going to be you know somebody who's not incorporated but the other three entities, partnerships, LLC's, or corporations are your options when it comes to creating a business entity around your business.

The main reason that people tend to create a business entity around them is for liability purposes. The nice thing about incorporating, whether you're going to be a corporation or an LLC is you get what's referred to as limited liability. The corporation becomes the liable party, not you individually. So let's just ...

Joey K.: Can you define liability? Liability is a word I'm sure you know what it means and I think I know what it means but let's just define it for everybody.

Andy C.: It means who is going to be responsible if there's a legal issue. So here's the situation. So you have you as the animator and you also have your company. If I wanted to sue you and I'm suing you based on something that you did on your own individual basis, I can come after you, I can come after your own personal assets. That is the real big issue. So if you don't have corporate protection or business entity protection, if you are sued and a judgment is against you then people can come after your individual assets.

So what incorporating does is it separates you from a business and then it's only the business that is exposed to liability.

Joey K.: Let me make sure I understand this. So, if it's just Joey as the animator and Joey gets sued and let's say they come after me for damages and I don't have that much cash to give they can repossess my car, they can go after my house, things like that. If I have a corporation that is separate from me they can only go after assets that belong to the corporation?

Andy C.: That is correct, absent other issues that might come into play if it comes down to that and we can have a discussion about that. But yeah, for the most part the main issue is liability. If I am going to be sued I want to make sure that my kids' college fund or that my house or that my car or that my own personal assets can't be subject to collection at a later date. That the only thing that could be is the judgment would attach to the business and then it's the business' responsibility to pay it.

Joey K.: So here's a question that I've always had and I've gotten this question a lot and I'm not really sure how to answer it but maybe you can help. I can understand having a risk of being sued if you make tires for example and one of the tires you made is defective and it pops and someone's car gets totaled. We're animators, we sit in front of a computer and we're clicking buttons and typing on the keyboard and then at the end of it we've created a video for someone that they put on T.V. or they put on youtube or other website. There doesn't seem to be any obvious risk of being sued. So I'm wondering if you've got any thoughts on what the dangers are for motion designers.

Andy C.: Well, I think the the big issues that motion designers are going to run into are obviously breach of contract issues. But again, if you're dealing with small sums of money, 2500 bucks or something like, you know, if it's a judgment against you personally most people can probably manage. Now to just sort of get my creative cap on to think about the exposure that you might have, yeah, I mean ... Here's the thing that you need to be careful of. You never know what somebody else is going to do.

So let's use this example. I hire you to create a fancy one minute introduction for my YouTube channel and you put it together and it's all awesome and you give it to me and now I have it, it's up on my YouTube channel. And now all of a sudden, somebody comes to me and I get a cease and desist letter from a lawyer that says, oh hey, by the way you have copyrighted music in your video and it belongs to my client and if you don't take it down now I'm going to sue you.

Copyright exposes you to huge amounts of damages if it is in fact copyrighted. And if let's say somebody comes after me for copyright infringement who do you think I'm going to drag into that lawsuit? I'm going to drag you in. Maybe you did it accidentally, maybe you did it on purpose. Maybe you thought you had the rights to something or better yet maybe what you did was you purchased a license for that music for a different project and not for this project and so it only applies to that last project. In other words, the license doesn't last in perpetuity it's only for the specific purpose that you purchase it. But you thought it would be great for my video and you put it together and now all of a sudden guess what, I'm being sued for copyright infringement and I'm going to drag your ass in too because that's on you.

And now I'm going to be subject to damages because it's a one minute video, the music in there it has 15,000 and there is a huge amount of damages that's associated with that. I mean it could be up to $35,000 if not more per infringement. And if there's 15,000 views do the math. That becomes a huge amount of damages on me and if I'm going to drag you in there on that too, well that becomes big money. And that might not be something you want against you personally but you can say hey, you're going to drag my company in because you and I our relationship is not based on Andy and Joey it's based on the Contiguglia Law Firm and School of Motion. And as a result of that because the nature of the business and the nature of the contract defines your company and my company then I also know that the people suing me for copyright infringement can't come after me individually, they can go after my company because it was my company that is using the materials and it is your company that produced them.

So that is an example that I could see definitely coming up. And having done enough copyright litigation over the years I've seen really crazy things that have come up. I represented a blogger a few years ago and there was, he pulled an image off of Google images thinking that oh, it's on Google, it must be public domain. Well, that's not accurate because the way Google pulls the information down, it spider crawls across the web, it just identifies all these different images and it then just identifies that. And so, he did a right click save as, took the image, put it into his blog and ended up getting sued by a company that purchased the copyright on those photographs that was affiliated with the Denver Post.

And so, here he was in North Carolina being sued in federal court in Denver for an image that he pulled off of Google images depicting the pat down searches at Denver International Airport. And the company that was suing him was from Las Vegas. He'd never been to Colorado and here he was defending a lawsuit in federal court in Denver. He's just a blogger. He's just talking about different things, he's taken images and commenting about them and aside from all the fair use stuff that is possibly there, he had to defend this lawsuit. He was right at the end that everything was okay but had he lost, a judgment against would have been against him individually because he just ran his blog as himself. And so, that becomes the problem.

Nowadays when you're looking around, there's a lot out there that is what I'll refer to as public domain and I think that not even a good way of defining it. It's material that people have put out there, that composers have put out there or that artists have put out there that they are willing to give you a limited license. I should do a video on this but have you ever read the Terms and Conditions of the music for You Tube or any of the free sites out there where you can grab music or grab images and things like that. It's really limited in terms of what you're allowed to use it for. And so, if you're not familiar with what those terms, even some of the websites where you can purchase a song to use in a video, you're only allowed to use it once. You can't use it multiple times. You have to purchase a license over and over and over even if it's a one dollar license.

I represented a yoga studio here in town and they put a bunch of really nice meditative type of music onto an iPod, put it up in their yoga studio and during yoga class they were playing it and they got a cease and desist letter from lawyers representing BMI which is one of the big licensing companies for music saying hey, you are infringing on our copyright and you better stop or pay us large amounts of money. Or hey, by the way, you could just go get a license from BMI for 750 bucks a year and you can use all of our songs without issue. And it depends on the type of license you get.

So there are some really goofy ways that somebody could get wrapped up into something without ever even knowing it. That's why I think just from a liability perspective put something between you and the other person and that something is your company, that becomes your shield.

Joey K.: I'm sitting here clenching and shivering. Like I'm sure people listening to this are terrified now because all of the things you've described are things that probably everybody in the industry has done, not on purpose but just by accident. I mean, there's a very kind of, it's like an open secret that when you're designing stuff and you're pitching things to clients, you're moving really fast and you're grabbing stuff off Google images and Flickr and whatever to just mock things up and photo bash things and it's all copyrighted stuff.

And so basically it sounds like the liability part of putting up and making a corporation is that if the worst happens, if you screwed up knowingly or unknowingly and all the sudden a judge says you owe 2.5 million dollars, your company can go bankrupt but you're still okay, you're still whole.

Andy C.: Great way of putting it, absolutely. Another thing, I'm sure there's somebody listening to this right now going about, but what about fair use, fair use, fair use. And I get the understanding and just to really, there are some limitations to which you can use somebody else's copyrighted material in your own work. If you're providing commentary, if you're doing it transformative, those are just a few examples. I did a video on it, it's on my YouTube channel about fair use. But the point that people fail to recognize when it comes to fair use is if you're raising fair use it means you've been sued. Because fair use is a defense to copyright infringement, it's not a permission slip to copyright infringement. And you have an obligation to prove fair use.

So if you're out there saying, yeah, but it's fair use, it's fair use, it's fair use, that's great, I hope you have the budget to defend that, because that going to be the issue later on. There's an artist in New York I forgot his name but he makes a living out of taking other people's Instagram photos, manipulating them a little bit, blowing them up and putting them in art galleries and charging large amounts of money for people to come in and take a look at other people's photos that he has transformed. And he has been sued multiple, multiple times in various states over this. He has been successful to some extent.

But most recently, and when I say most recently, I mean within the last year or so, he's been sued in New York and the judge is like, listen guys, you don't get to just file a motion to dismiss and say that this is fair use because fair use has a laundry list of terms, a laundry list of items that a court needs to consider to determine whether it really is fair use. And if you don't meet those terms, guess what, not fair use. But, who do you have to go to, what do you have to go through? You have to defend that lawsuit in order to present your case that it is in fact fair use.

So, I hear people say yeah, but this is fair use and I'm like great, are you prepared to litigate that issue. Are you prepared to go to trial and fight this against Google, against the Denver Post, against any of these other people who might have a much bigger bank account than you. And if you are, great, go for it. If not, pull back. So, the best thing to do and we started this conversation off with liability, we've sort of now segued into copyright a little bit. I think the best thing that people can do and you'd be surprised how cooperative people can be. Call him up and ask him, hey, I came across your image, I love it, I'm a blogger, I'm an animator. I would love to be able to use your image in something that I produce. Would you give me permission to do that? What's the worst thing they're going to do, say. But many times, people would be flattered. Yeah, I would love to. Just give me credit for it, great.

Formalize it with an email. Formalize it with something that shows that you've been given permission for it and then move forward and utilize it. Sometimes that 15 minutes of uncomfortable news can save you a lifetime of just such anguish.

Joey K.: Such amazing advice. I have to say too that nowadays it's so easy and inexpensive to get stock imagery, stock music, you know, stock music used to cost three to five hundred dollars per use and now you go to PremiumBeat and it's like 40 or 50 bucks. You can get an Adobe stock membership for 30, 40 bucks a month or a Shutterstock membership. It may seem expensive but I guarantee it's a lot less expensive than getting sued.

Andy C.: It is. But even under those circumstances, make sure you read through the terms and conditions of what you're allowed to use it for. Some of these licenses that are put out there, you're not allowed to use it for commercial purposes meaning you can't make money off of it. If you're doing it for fun and you want to add it to your video because hey, this is my travel video, I'm going to share with my friends and family, great. But if you're now putting it into a commercial and you're trying to drag and bring people to your website so you can earn money off of it, that becomes a commercial use. And sometimes in situations like that the people who own the copyrights on that are going to be like, listen, I don't mind you using my stuff but guess what, pay me five bucks for a license to go ahead and put it in your commercial if you're going to generate income from it. I put a lot of effort into that.

I'm sure every one of your listeners will be pissed off as hell if somebody pilfered the things that they spent three weeks developing.

Joey K.: This copyright conversation has made me really uncomfortable for some reason. It's kind of one of the scariest parts of what we do because there's a lot of rules, there's a lot of unknowns. It kind of feels like everyone's kind of cheating and just hoping they don't get caught but hopefully from this conversation at least everyone listening kind of understands that there are risks however small they might be that if you get caught the consequences can be enormous and incorporating can provide a buffer between you and the person suing you.

So, let's talk about corporations a little bit more. You mentioned that there's corporations, there's partnerships, there's sole proprietorship. Can you briefly just kind of describe what the differences are?

Andy C.: Just to sort of recap. The business entities that we have are corporations, partnerships and those include general partnerships, limited partnerships, limited liability partnerships or limited liability limited partnerships. Those are all different forms of, I know, and limited liability companies. I'll tell you this. I have taught a course on business entities and it's a form of course at three hours a day. The depth that this goes into is incredible. Let me see what I can do to simplify this as much as possible.

So, starting with the first one, corporations. Really what people have defined as the formal business entity. You have C corporations and you have S corporations and real briefly the difference between the two is the nature of how they are taxed. A C corporation gets what's referred to as a double taxation. An S corporation is taxed as a partnership and you get with referred to as flow through taxation. I'm going to into a little bit more detail on that as well. Then you have partnerships. In these limited liability partnerships, similar situation, you have flow through taxation issue regarding that but it's still a business relationship where the business is owned by the partners whereas in a corporation the business is owned by shareholders and then you have limited liability companies where the business is owned by members.

The owners of each of these they are given different names and they are specific to that type of business entity and it drives me crazy when people go oh yeah, my partner, my partner, my partner. I'm like, what kind of business entity are you? Oh, we're an S corporation. All right, so they're not a partner. A partner is part of a partnership. A member is a part of an LLC. A shareholder is part of a corporation. So that's how those are defined. And really what you do in each of these situations whether you are a member, whether you're a partner, whether you are a shareholder, those designations define your ownership interest in that business entity. And you can own 100%, you can own 50%, 10%. And what you see people doing is selling portions of their company or [inaudible 00:22:37] out interests in their company. So and so is a 5% owner, so and so is a 10% owner.

And that's really sort of how those are all broken down. But they all function very similarly. And what I mean by that is they provide you the appropriate protection with the exception of a general partnership or a limited partnership. If you want the limited liability which is what a limited liability company and a corporation give you, in other words, company is liable, not you individually, you need to be a limited liability partnership. So you have to have that designation of limited liability.

Now the interesting thing here is all of these business entities are created at the state level. And what I mean by that is you will incorporate or you'll create your business entity at the state level. You'll incorporate in Delaware, you'll incorporate in Florida, you'll incorporate in Colorado, whatever it is but that is where the creation of your business entity begins is at the state level. The state that you decide you actually want to incorporate in. That makes sense?

Joey K.: That does make sense. I think everyone listening, I guarantee that no one listening is going to want to sit through. I'm sure it's very interesting Andy but the four-month course, three hours a day [inaudible 00:23:58] business entities. What they're wondering is, like at the bottom of it is which one's right for me. And let's try to simplify it a little bit. Once you get multiple people involved, if you have multiple, you know, business owners or shareholders or members, then it gets more complicated. But for a freelancer, just a one man band or a one woman band, generally it seems like an LLC or an S corporation would be the most useful in corporation to start.

So, A, would you agree with that? I'm wondering if you could kind of talk about the differences between those two.

Andy C.: First of all, somebody operating on their own can't be a partnership. The reason for that is the definition of a partnership is two or more people. So, as an individual you cannot be a partnership, so let's just throw that one right out. So if we're just talking about a single person, your options really are then a sole proprietor, a C corporation, an S corporation or a single person LLC.

Now, the interesting thing is here from a tax purpose and I'm going to caveat this discussion on tax with I'm not a tax lawyer, I know very generally about the tax laws. When it comes to taxes, it's so very important to consult with a tax attorney or your accountant to really determine what is going to be the best business structure for you from a tax basis. All right. So make sure that you get the proper tax advice from a licensed tax professional before venturing into this and I really have to sort of caveat all of this because the federal government really doesn't like that and I don't think my malpractice carry would either.

But let's sort of get into this very generally. So, from tax purposes if you're in LLC, you're going to be treated as what's referred to as a disregarded entity because for tax purposes, a business entity from a tax standpoint is either disregarded meaning an LLC. So an LLC is not classified by the Internal Revenue Service but what is are C corporations, S corporations and partnerships. When you apply for your business designation, that's at the state law level, so how the state classifies you as a business entity does not necessarily mean that you're going to get the same tax classification as a business entity. And as I said, a state limited liability company or an LLC has an option at the tax level whether it wants to be taxed as an S corporation or as a disregarded entity.

The tax classification is important because the different types of entities are very different. So when it comes to those, a disregarded entity like an LLC will be treated like a sole proprietorship. In other words, the owner owns the assets and is subject to the liabilities and reports the income and expenses on his her own personal income tax return. So that's how that follows through.

When it comes to a C corporation, a C corporation is defined as something that is not an S corporation. So if it's not an S corporation it's a C corporation and is subject to two levels of taxation on it's income. One at the entity level, in other words the business, the corporation gets taxed based on the income the corporation receives and then another at the stockholder level when it's distributed. So if you're a C corporation and you own 100% and let's just say your company has $100,000 profit, the company gets taxed on that $100,000 profit. If then you also receive $100,000 salary you then get taxed individually on that $100,000 salary that you received. That make sense?

Joey K.: Yeah.

Andy C.: So that's commonly referred to as what's referred to with double taxation. The company gets taxed and then the individual shareholders gets taxed on the money that they've actually received. When it comes through to an S corporation and this is similar to a partnership both of these are passed through entities for the purposes of taxes meaning it doesn't pay tax at the entity level. Instead the profits and the losses pass through to the stockholders who then include those items on his or her own individual tax returns. Does that make sense?

Joey K.: Yes, and I'm going to do the thing where I try to explain it the way I see it in my head. You can correct me if this is wrong, okay. I'll translate it into motion designer speak. So if you don't have a corporation and you're operating as a sole proprietorship, where it's just you and maybe you register your name as a business name or something like that with city hall. If you make $100,000 that year then on your tax return you will declare that you made $100,000 and you can get some deductions and things like that and then you'll pay taxes on that.

If you form an LLC, essentially it's the same thing. When you send an invoice, you'll send an invoice from your company, you won't send, you know, Joey Korenman doesn't send the invoice, School of Motion sends the invoice. Any money that School of Motion earns it passes through directly to Joey. School of Motion doesn't pay taxes, Joey still pays the taxes. I'm I on the right track so far?

Andy C.: Correct. And really what happens here in that situation is Joey is going to pay taxes on whatever the profit is that the company makes even if Joey doesn't receive it. That's really the key. So, let's just say School of Motion as an LLC makes $100,000 profit and keeps $100,000 in the bank or let's just say $50,000 in the bank and sends a check to Joey for 50k. Joey's going to pay taxes on 100,000 not the fifty. You're paying your taxes based on the full amount that the company makes and not the what has been distributed to you. That's sort of the downside to these flow through tax entities because the individual owner is going to be taxed on the entire sum that the company makes in proportion to what they own. So if you have a partner, you'll each pay your portion of that.

Joey K.: I want to bring up something that you just mentioned because this was something I did not understand at all the first time I incorporated. I didn't understand that ... One common thing to do is you set up a corporation, School of Motion. School of Motion earns income and then School of Motion pays Joey a salary. And so, initially I thought, oh, well that's great because if School of Motion makes a lot of money but I don't feel like paying all these taxes on it I'll just leave it in the company and just pay myself a smaller salary and then maybe the next year I'll pay myself a bigger salary and it doesn't work that way. Whatever the company makes if it's an LLC or if it's a single owner S corporation, it passes right through to the owner and you're paying taxes on it.

Andy C.: That's absolutely correct and the same thing with an S Corporation as well. Typically what tax people are going to tell you to do is listen, expect to pay taxes on all the money that you're going to receive. Sometimes the best things to do is give bonuses to your employees. Spend the money if you don't want to pay taxes on it or give it to you or take a bonus yourself. You don't want to pay taxes on money that you didn't actually receive and that's kind of the problem that you end up running into with some of these flow through entities is that you may end up paying taxes on a full amount of income. You better make sure that you've withheld enough from an individual basis.

Joey K.: Yeah, exactly. And this is a good point to just once again reiterate that you should definitely have an accountant if you incorporate, even if it's an LLC which from a tax perspective is fairly simple everything flows through to you the owner, there are still tax implications in terms of how things have to get filed and things like that. This might be a good place to talk about the the advantage of not doing an LLC from a tax perspective and doing a corporation. You mentioned there's two types of corporations, S corporations and C corporations. I would just probably make a blanket statement. No individual should have a C corporation, seems typically like publicly traded companies with lots of shareholders those are the types of companies that do a C corp. Is there any other reason that a freelancer should do a C corp?

Andy C.: Well, it really depends. If you're looking to start a big business and raise a lot of money, there are limitations on what an S corporation can do. Like an S corporation, you're only allowed to have one class of stock, you're only allowed to have, you can't have more than 100 stockholders within certain exceptions. The stockholders have to be citizens or residents of the United States. For the most part, it's a much more common entity than C corporation.

The problem that you may run into is if you're going to be a corporation and then change later on you could run into problems from a tax basis. In other words, if you're C corporation when you incorporate and then you decide that you want to make an S corporation election after the formation and you don't do it within the proper time frame there could be adverse tax consequences to that too. In other words, you may end up paying taxes on money that or I'm sorry on assets that appreciated in value during the time that you were a C corporation. That becomes a really big issue.

What I tell people is listen, always get an accountant on board and talk to your accountant or your tax advisor, whether it's a lawyer or an accountant to really decide what is the best entity structure for you from a tax purpose. I can talk to you about business entities from a liability standpoint when it comes to lawsuits and things like that but when it comes to tax purposes I think really getting your C.P.A. or your tax lawyer on board is really the important thing to do.

These little nuances can really make a difference in terms of maximizing the gain that you have from a business standpoint.

Joey K.: Absolutely. I asked in preparation for chatting with you today, I actually asked my C.P.A. a bunch of questions because I understand just enough of how this works. I'm going to attempt to explain it and you can kind of correct me if I screw anything up but from my understanding, from a tax perspective an LLC is basically the same as no LLC. If you just go out and you make money or you set up an LLC and make money through that from a tax perspective there's no difference. Now if you make an S corporation there is a difference and I'm going to attempt to explain what it is here.

So there is this really crappy thing in the United States called the self employment tax. So if you go out and you get hired by somebody, you just get a job, then what happens is your income is taxed and there's a couple of taxes that you pay. Social Security and Medicare, which for some reason, some historical reason your employer splits that with you. So you pay half of that tax, comes out of your paycheck but the other half the company pays for. Now, when you go freelance all the sudden you're required to pay all of that and that's called the self employment tax and it ends up, it depends how much you make but I think it can end up being like 15% or something like that. How am I doing so far, Andy?

Andy C.: You're doing great and I think that's really an important aspect of it, with the business entity protection, one of the things that you do is you get to sort of split the cost of that self employment tax among many other people.

Joey K.: Yeah, exactly. But as a freelancer, if you have an LLC you're getting that full self employment tax because everything that you're earning is being taxed as income. So when you get a paycheck from your boss that's income. If a client writes you a check as a freelancer that's also income.

So now here's the cool thing about an S corporation. An S corporation allows you to be a shareholder in your own company. So as a freelancer you could call yourself Animation Incorporated and you are the sole shareholder of Animation Incorporated, you own 100% of all of the shares and it's kind of a weird concept. Now, Animation Incorporated earns $100,000 that year. You can pass all of that through to you as income so you earned 100 grand that year and you'll pay the full self employment tax on that entire 100 grand. But there's another option, because you are a shareholder of that corporation you're actually allowed to take what are called distributions.

So it's kind of like if you buy Coca-Cola stock or McDonald's, like one of these blue chip stocks, a few times a year you'll get a check from them. You'll get a distribution from them based on profits. So you're able to do that as a shareholder in your own company and that is not taxed as income, it's taxed differently. And so you don't have to pay the self employment tax on that income. How am I doing, how am I doing?

Andy C.: You're doing good and I think the important aspect of this here is when you receive a distribution, that is typically taxed at a different level than the ordinary income. So when you receive money as a sole proprietor that gets taxed at the ordinary income rate which is a higher tax rate than a distribution which typically from what I understand is taxed at a capital gains rate which is a lower tax rate. So you see people who want to give themselves distributions and things like that but that's a little bit different as an S corp. If you're an LLC you're not going to get that type of advantage, if you're a partnership you're not going to get that type of advantage.

Joey K.: Right. School of Motion is set up as an S corporation for that reason and the way that my C.P.A. explained it to me is this. If you pay yourself, let's say that there's $100,000 to play with. If you pay that to yourself as income, then it's taxed as income, you're going to pay the 15% self employment tax. But if you pay yourself a salary of 50,000 and and then you take 50,000 in distributions then on the 50,000 that was your salary you pay the self employment tax but on the other 50,000 you pay less taxes.

So, you're essentially keeping more of the money that your company's earning by being an S corporation. And there's lots of rules about this. The obvious question is well why can't I just pay myself all of my salary through distributions. Well, the I.R.S. doesn't like that and they'll come after you and you need an accountant to counsel you.

Andy C.: There's a limitation in terms of your income, in terms of the amount that you are allowed to take as distribution income and what you have to pay your ordinary income and your personal taxes on. In that respect, tax planning is all very important and there are ways that you can minimize your tax liability but that's beyond my knowledge. Talk to your accountant. When you go through your tax returns all of those things are taken into consideration.

Joey K.: Yeah, 100%. You have to talk to an accountant that knows what they're doing to do all of these things. In the end, when freelancers ask me should I incorporate. It sounds like at this point from our conversation I would just say yes. Simply from the liability standpoint it's smart to do. It's getting really inexpensive and easy to do but S corporations are a little more complex in terms of the requirements to maintain them and you have to have officers and minutes and things like that. So they are a little more expensive to set up and run. And so, there's basically a math problem that your accountant can help you with and that math problem goes something like this. If the tax savings that I'm going to get from having the S corp is greater than the cost of operating the S corp you do the S corp otherwise you do an LLC.

Andy C.: Right. If you don't want to put the efforts in to managing a corporation the proper way, don't do it. Do an LLC. The nice thing about LLC is it's a real simple business entity. It was created for its simplicity. The formalities aren't there, you don't have to have minutes, you don't have to have annual meetings, you don't have the corporate formalities that you do with an S corporation or C corporation and you still get the limited liability. So from a liability standpoint, you're protecting yourself from individual liability by using that business entity. And that becomes you know really beneficial to you. Corporation wise you need to maintain the formalities of that. You need to make sure that you keep your minutes.

And from a legal standpoint, from a litigation standpoint I've got to throw this in there is because corporations are viewed as a more formal business entity or a business structure than an LLC or partnership, courts have a tendency to give it more credibility. I bring that up because in the litigation that I have seen recently with issues of what's referred to as piercing the corporate veil and that is when somebody is sued and the person suing them is able to go past the business entity and go against the individual's personal assets to collect or hold them individually accountable, the cases that I've seen that happen in most have been where the business entity pierced was an LLC.

And part of the reason for that is because because the formalities are so limited people have a tendency to be more free spirited with the entity and not take things seriously and go out and buy personal grocery on their business credit card and commingle things like that because it's a little more lackadaisical. And as a result of that you see people making mistakes in the operation of their business. They think oh, I'm an LLC and therefore I'm automatically protected but what they don't realize is they're still, they have one credit card for the company and they're using it for their own personal stuff or they have their own personal credit card and they're using it all for business stuff.

And you see the sort of commingling of things and the business entity just becomes an alter ego, it's just a spin off of you personally. And then you see those people get you know hit individually. If you're going to be an LLC you still have to manage it properly. And what I mean by that is make sure you have your operating agreement. Make sure you have separate bank accounts. Make sure that even though it's not required, meet with the other members once a year and put things in writing and make it formal and do all the things that you would normally do for a corporation with your LLC as well. The level of formality that you give it will actually end up protecting you in the long run.

Joey K.: I want to reiterate what you just said because it's super important that there's this concept of piercing the corporate veil. It sounds like this really cool kind of ninja like thing. From my understanding it basically means if you have a corporation and you feel protected, oh, if I get sued, the corporation can go out of business but they can't touch my house, they can't that's my car, that only works if you follow the rules and the rules are essentially they have to be totally separate entities. You can't take your company credit card and buy yourself a new home theater and call it a business expense. If you get caught they're going to say, well, you and the business really aren't separate so we are going after your personal assets.

Andy C.: Absolutely right. And what I see is, here's how people justify it. Well, yeah, I went out and I bought the home theater with my business credit card but the company owed me $5000 and I'm like great, then guess what, cut yourself a check. Cut yourself a check from your business, deposit it into your own personal account and then go buy your home theater with your personal money. So you've earned your income, now what you do with your income after that is entirely up to you but unless that home theater is somehow related to your business you're going to have problems.

Joey K.: Exactly. We talked briefly about the filing requirements of these two entities. With an LLC it's not very much, you pay a lawyer to set it up or you go on legalzoom.com or something like that and then I think once a year there is basically a fee that you pay. For an S corporation there's a lot more than that and I'm wondering, Andy, if you can just kind of briefly describe what those requirements are and I'm assuming that that's something you help your clients with. And how much does that cost if you're helping a business meeting all that?

Andy C.: Absolutely. For the most point, I tell people listen, you can incorporate on your own. It's really pretty easy to do and so the creation of a business entity as I mentioned earlier starts at the state level. So every state has what's referred to as a secretary of state's office. The secretary of state's office is the state organization that hands out the designations for various businesses to create your business entity. So if you look on your local Secretary of State website you will see a plethora of information about the various business entities that are available in your state. And you can typically log in, you can create a new business entity, fill out the form, pay the filing fee and boom, all of a sudden, there you are, you are now a corporation or you are now an LLC.

What you do from that point then is go to like the I.R.S. website, take your certificate of good standing, put in that you're a new corporation or a new LLC, file for a tax identification number. You can do that online as well through the irs.gov and then bang, you've got yourself a tax ID number for your new business. So now you've got your certificate of good standing, now you've got your bit year tax ID number, you run off to the bank and you open up your business account. Here you go, here's my certificate of good standing, here's my tax ID number. Now I need some checks, I need a credit card and you're off and running. You're an operating company at that point. It is pretty simple to do.

Now when it comes to if you have multiple owners of these companies, the best thing to do is have, you know, for an LLC you're going to need an operating agreement at a minimum even if you are an individual who owns your LLC I think it's a good thing to have. Many banks will require you to have a completed operating agreement just to show that you're taking it seriously and are not just running off and opening up business entities but that you're taking the time to to create and organize it. The operating agreement is the contract that governs the management of the LLC and the ownership of the LLC, the splitting of the interest. So that can all be done in one document.

When it comes to corporations, typically what you'll do is you'll have your articles of incorporation. You will have a shareholder agreement that defines the ownership relationship of the shareholders and what the ownership interest is, whether you own 100%, whether it's split 50-50. What you can and cannot do with the shares of stock that you have and that goes into a pretty big conversation down the line. But then you also have bylaws. Bylaws are the management of the company or of the corporation.

What I tell people is listen, in a business, you're going to wear one if not all of these three hats. So the first hat that you might have is ownership. You can be an owner of a business. So that's hat number one. Hat Number two is management. Hat number three is employment. So, you can be an owner of a company but never be in part of managing. So you may not sit on the board of directors but you may end up owning it. Think of that like you own shares of stock in Adobe, I don't know if they're public or not but if you own shares of stock in a public company there you are, you're a shareholder in that company but you don't sit on the board of directors and you're not an employee but you might also be a manager. Look at many of the companies out there that just hire people to be on their board of directors to help manage the company that don't have an ownership interest in it. And you can do that.

And I've seen small companies say, I really like this guy's ideas. He's going to come in, he's going to sit on the board of directors and this individual is going to help me manage my company and he will not own it. Then you have employees. Maybe you want to hire somebody who's going to be the business director and so you say hey, can you come and help me out be my business director and you'll be an employee. Now in a small business or as an entrepreneur we might wear three of those hats. We might be the owner, we might be a manager and we might be an employee. So those are the three classifications of a business entity really is what it comes down to.

Joey K.: So, one last thing I want to talk about and you brought it up right at the beginning of this conversation about corporations is that one of the other advantages you can get from having a corporation comes if you start to hire people. So I'm wondering if you can talk a little bit about how having a corporation could help you if for example you start as a freelancer and you start an S corporation for the tax benefits and you're operating on your own but then after a few years you start getting more and more work. And after a while, you say, you know what, I could kind of justify bringing on a junior animator to help me with all this work. What does having the corporation help you with in terms of having employees?

Andy C.: I think the important thing here is obviously for liability purposes, if you end up with employee disputes you want them obligated to the company and to you individually. So I think from a liability standpoint that's really important. But the reality is, do you need a corporation to have employees? No. Would I advise it? Absolutely, I think you should. So again, it's no different because you're entering into relationships with these people, you're entering into a legal relationship with them. They are employees and so now you have employment laws that need to be accounted for. Primary one being, you can't force somebody to work more than 40 hours a week unless you pay them overtime after 40 hours. They can't work more then you know a certain number of 12 hour shifts in a row. And again, I don't know the whole details on the employment aspect of things.

The laws that are in place for employees are much different than the individual if they're just an independent contractor. The more you start to control somebody's time with you the more they're going to be an employee of your company rather than an independent contractor. That's another conversation that we can certainly have.

From an employment standpoint I think the last thing you ever want to do is if there's going to be an employment dispute you would rather have that disgruntled employee fighting with the company than with you individually. And in some circumstances, you can buy insurance to protect yourself from employment related disputes. You can have HR companies represent you and they may put requirements in place that you be a business entity as well.

So again, this is about liability. This is about separating you from everybody else and protecting you, Joey, not School of Motion. I mean, it protect School of Motion but the important thing here is keeping you as separate from the company as possible.

Joey K.: You know, this is such a rabbit hole. I think everyone listening was kind of maybe hoping that there was just some simple tips, five easy tips to not get sued. The reality of it is it's just so much more complex and there's so many ins and outs. So, let's leave it at this, you've been super generous with your time. One more question. Someone listening and they've heard this entire conversation from contracts to incorporating and with a little bit of copyright law thrown in there. And let's say that they're about to go freelance and they want to do it the right way but they're overwhelmed. What's a good starting point? Should they just get on legalzoom.com and pay a couple hundred bucks to do this or should they go find a lawyer and start a relationship and do it that way?

Andy C.: Again, the answer, it depends.

Joey K.: Oh, come on.

Andy C.: It's going to depend on your budget. Now, I will say this. I am not a fan of legal forms but I will say that they do provide a purpose. One of the purposes is they're inexpensive and you can go to companies like Legal Zoom or just ask a lawyer and buy a template. But unless you have the sophistication of understanding what the contract means, just because you go and buy an operating agreement from Legal Zoom or you go buy a services agreement, a generic services agreement from Legal Zoom or from somebody else, do you really understand what it means? Do you understand when it goes through and it says insert governing law here and you're like, well, what do you mean, what does that mean. Insert venue clause here, what does that mean.

If you're sophisticated enough to understand and interpret what those contracts mean, then by all means go ahead or educate yourself. Listen to podcasts like this, watch videos that are on my YouTube channel to learn about the different areas of law so that you can protect yourself. So get educated about what you're going to do. Don't just go out there and purchase these things with the hopes that it's going to fit because just because you go grab a hammer out of the tool box it doesn't mean you're going to get the screw in properly. Can you get a screw in the wall with a hammer? Absolutely. But is it the right tool for the job? No, it's not.

Making sure that you have a the proper understanding of how things operate and making sure that you understand that you have the right contract for the right deal, that's it. And then most importantly, if you're going to go into these forms, still take the time to build the relationship with your client. Really sit down and help understand what the needs of the client are because what I find is the lack of communication between the parties is really the cornerstone as to the problems that they end up having later on. If everybody's on the same page and everybody trusts one another and everybody is willing to work with one another, it makes the deal making portion of this so much easier. And that is all part of the preventive law. That is all part of my pitch to make sure that you understand what you're doing and take the precautions now so you don't run into problems.

Joey K.: And that's it from Mr Andy Contiguglia. Head over to contiguglia.com/schoolofmotion. That's Contiguglia, C-O-N-T-I-G-U-G-L-I-A.com/schoolofmotion where Andy has left a little gift there for our listeners and he also has a bunch of free videos that can teach you some basic legal ideas and help you get your head wrapped around some of these very grown up concepts. Now I know the stuff is not the sexiest information to go through but if you plan on being a professional in this field you kind of have to bite the bullet and deal with legal issues. Thanks as always for listening. Check out schoolofmotion.com for show notes and information about all the amazing classes we offer and I will catch you next time.

ENROLL NOW!

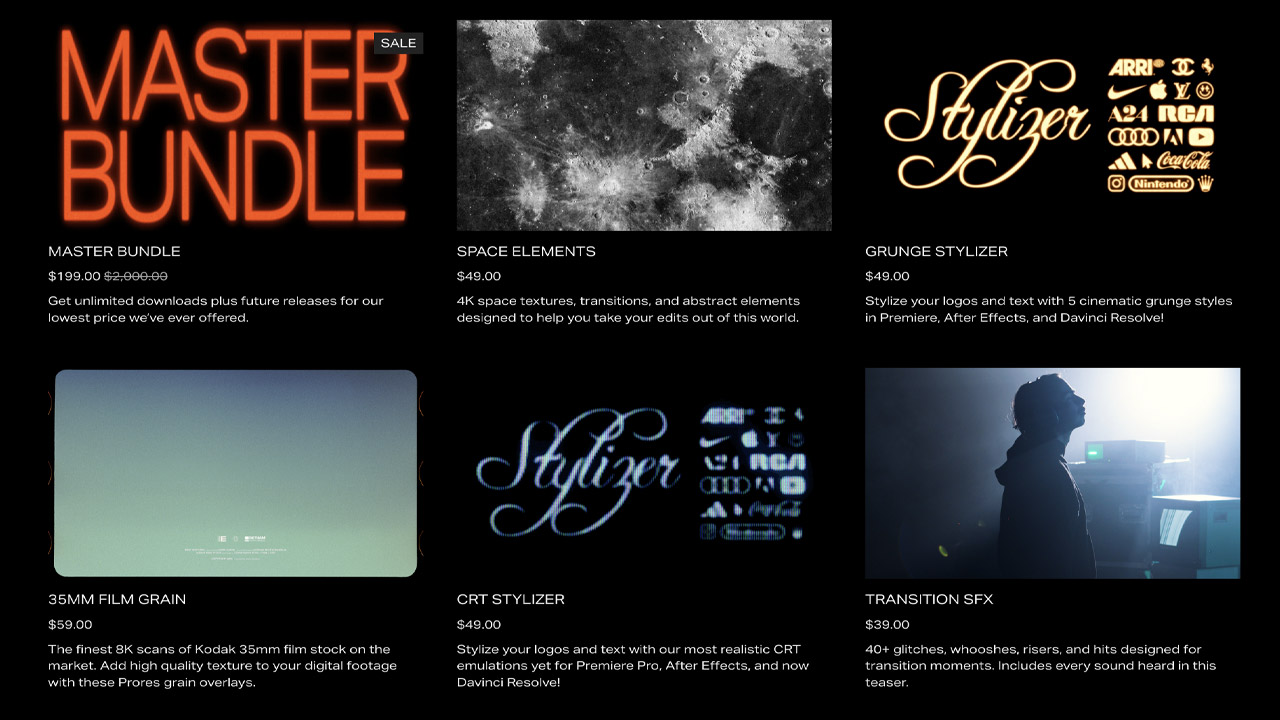

Acidbite ➔

50% off everything

ActionVFX ➔

30% off all plans and credit packs - starts 11/26

Adobe ➔

50% off all apps and plans through 11/29

aescripts ➔

25% off everything through 12/6

Affinity ➔

50% off all products

Battleaxe ➔

30% off from 11/29-12/7

Boom Library ➔

30% off Boom One, their 48,000+ file audio library

BorisFX ➔

25% off everything, 11/25-12/1

Cavalry ➔

33% off pro subscriptions (11/29 - 12/4)

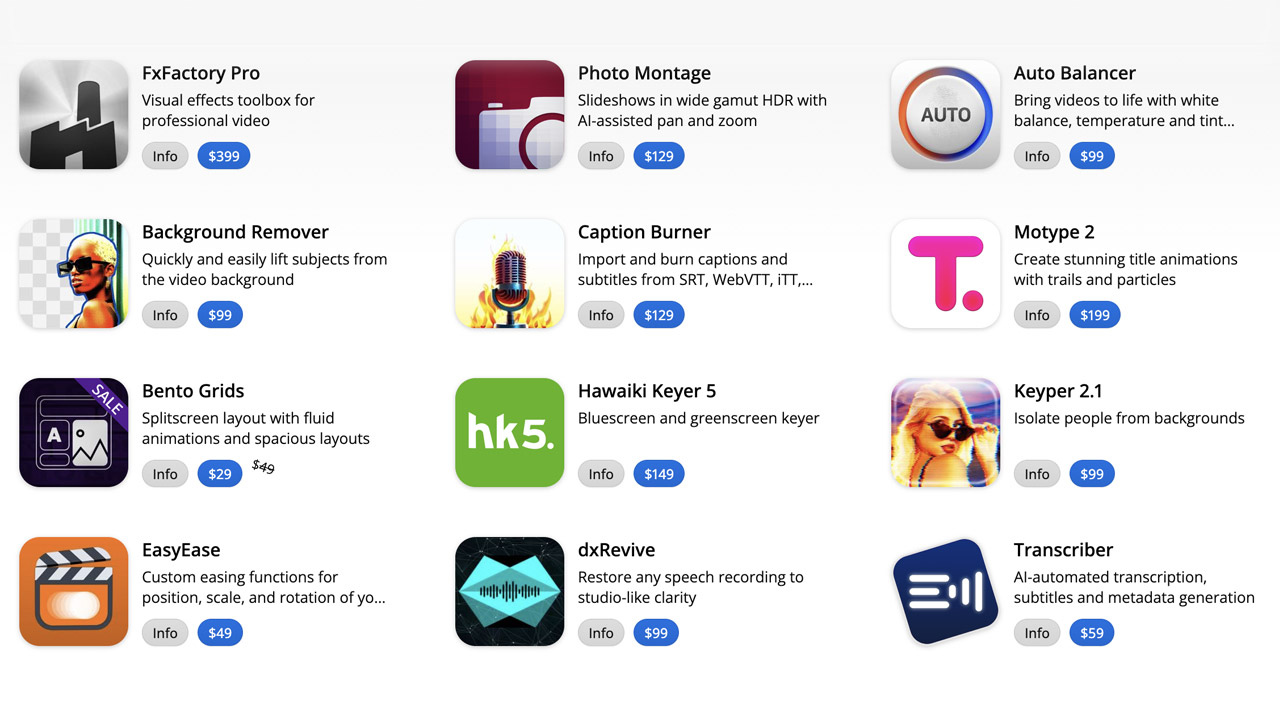

FXFactory ➔

25% off with code BLACKFRIDAY until 12/3

Goodboyninja ➔

20% off everything

Happy Editing ➔

50% off with code BLACKFRIDAY

Huion ➔

Up to 50% off affordable, high-quality pen display tablets

Insydium ➔

50% off through 12/4

JangaFX ➔

30% off an indie annual license

Kitbash 3D ➔

$200 off Cargo Pro, their entire library

Knights of the Editing Table ➔

Up to 20% off Premiere Pro Extensions

Maxon ➔

25% off Maxon One, ZBrush, & Redshift - Annual Subscriptions (11/29 - 12/8)

Mode Designs ➔

Deals on premium keyboards and accessories

Motion Array ➔

10% off the Everything plan

Motion Hatch ➔

Perfect Your Pricing Toolkit - 50% off (11/29 - 12/2)

MotionVFX ➔

30% off Design/CineStudio, and PPro Resolve packs with code: BW30

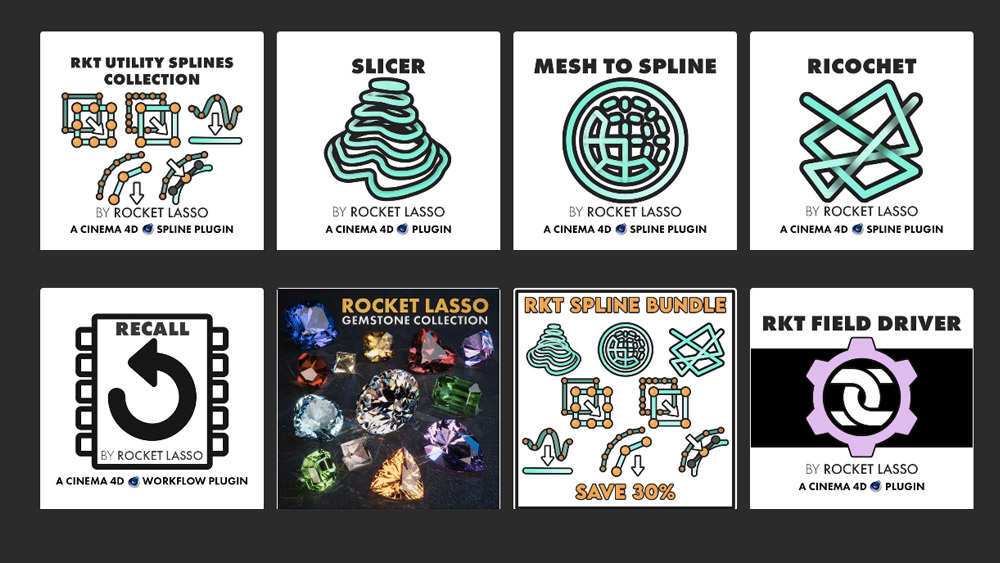

Rocket Lasso ➔

50% off all plug-ins (11/29 - 12/2)

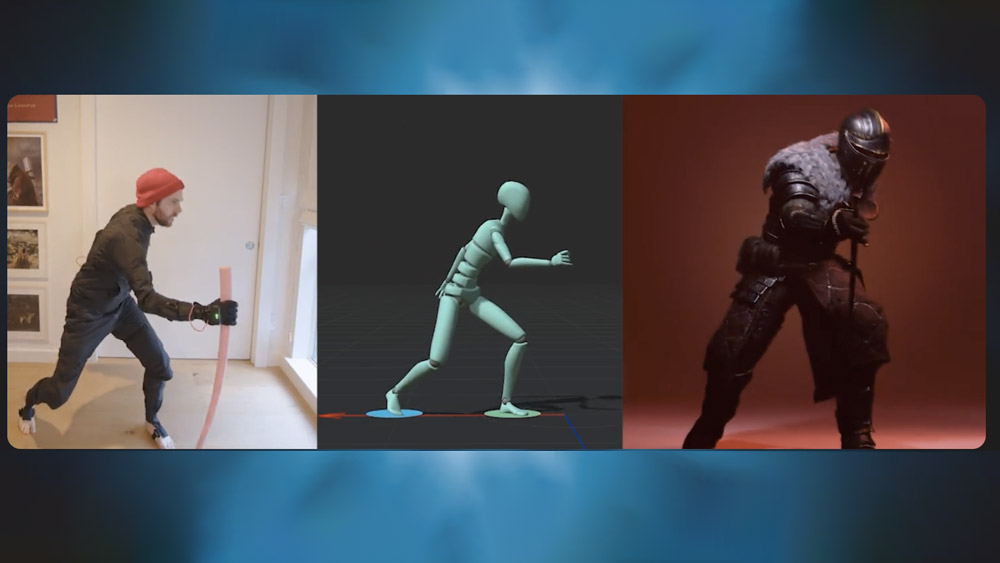

Rokoko ➔

45% off the indie creator bundle with code: RKK_SchoolOfMotion (revenue must be under $100K a year)

Shapefest ➔

80% off a Shapefest Pro annual subscription for life (11/29 - 12/2)

The Pixel Lab ➔

30% off everything

Toolfarm ➔

Various plugins and tools on sale

True Grit Texture ➔

50-70% off (starts Wednesday, runs for about a week)

Vincent Schwenk ➔

50% discount with code RENDERSALE

Wacom ➔

Up to $120 off new tablets + deals on refurbished items